EU Softens 2035 Zero-Emission Target, Raising Alarm Among Electric Vehicle Startups

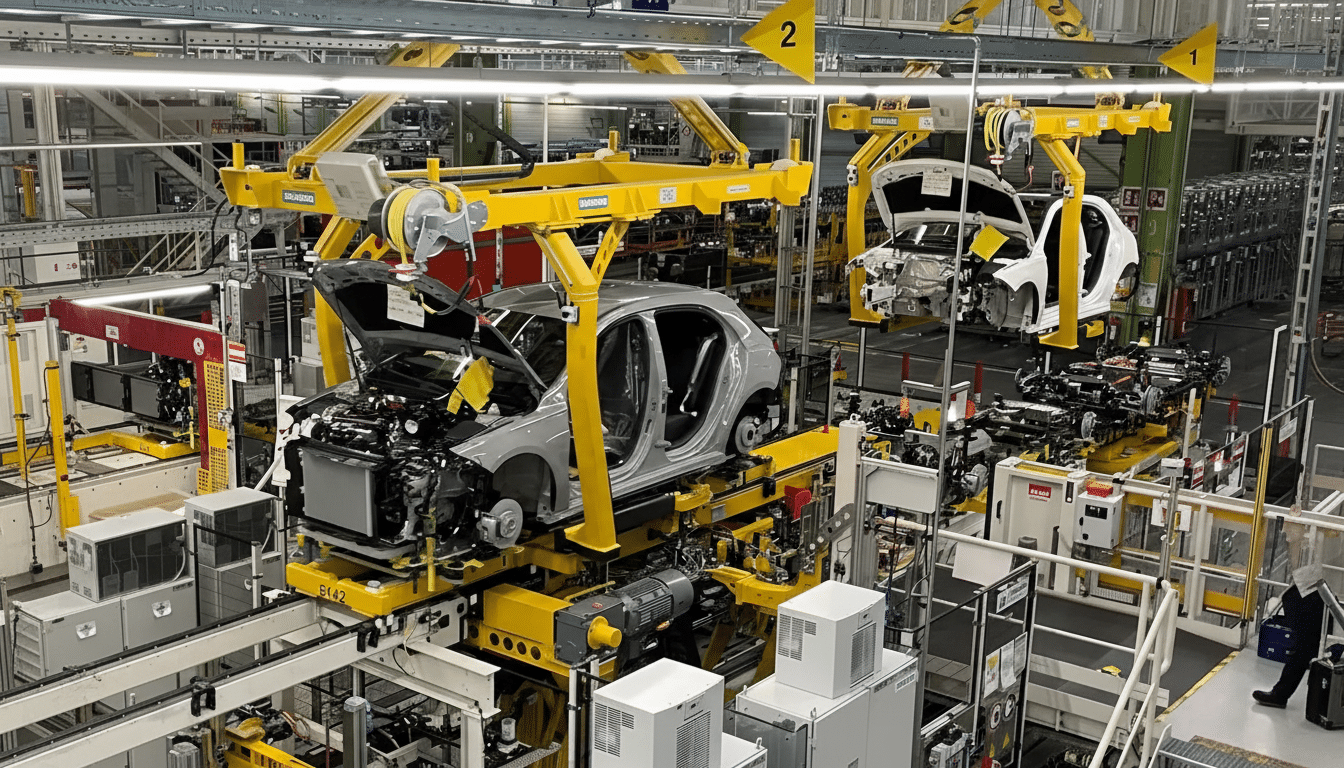

The European Union’s long-promised transition to an all-electric automotive future has hit a potential delay, sparking unease among electric vehicle (EV) startups and clean-tech investors across the continent.

The European Commission has proposed a revision to its flagship 2035 policy that would have required all new cars sold in the EU to be zero-emission. Under the adjusted framework, up to 10 per cent of new vehicle sales could still include hybrids or other non-zero-emission models, provided manufacturers offset the associated carbon emissions. The proposal forms part of a wider “Automotive Package” aimed at balancing environmental goals with the competitiveness of Europe’s car industry.

If endorsed by the European Parliament, the move would mark a significant concession to established automakers who have argued that the original timeline was too aggressive. Many legacy manufacturers are struggling to keep pace with Tesla and a growing wave of lower-cost electric vehicles produced in China. However, the softened stance has deepened divisions within the EV ecosystem.

“China already dominates electric vehicle manufacturing,” said Craig Douglas, a partner at World Fund, a European climate-focused venture capital firm. “Without clear and ambitious policy signals, Europe risks surrendering leadership in another globally strategic industry — along with the jobs and economic value it creates.”

Douglas is among the signatories of Take Charge Europe, an open letter sent in September to European Commission President Ursula von der Leyen. The letter, backed by senior executives from companies such as Cabify, EDF, Einride and Iberdrola, as well as several EV startups, urged the Commission to uphold the original 2035 zero-emission deadline.

Despite the appeal, pressure from the traditional automotive sector — which accounts for about 6.1 per cent of total EU employment — appears to have influenced the policy rethink. The outcome has triggered broader debate about whether flexibility now could weaken Europe’s long-term position in the global energy transition.

Industry Divided Over Direction

Differences of opinion extend even within the automotive industry itself. In comments to Swedish media, a Volvo spokesperson warned that retreating from long-term commitments in pursuit of short-term relief could damage Europe’s competitiveness for decades.

Volvo, unlike some of its peers, has indicated it is prepared to meet the original 2035 deadline. The company has instead advocated stronger public investment in charging infrastructure, a concern shared by critics who fear the revised policy may reduce incentives to expand Europe’s charging network.

Issam Tidjani, chief executive of Berlin-based EV charging marketplace Cariqa, echoed those concerns, arguing that weakening the mandate risks slowing electrification. “This kind of flexibility has never delivered the intended results,” he said. “It delays scale, weakens learning curves and ultimately erodes industrial leadership.”

To address supply-side challenges, the Commission has also unveiled a €1.8 billion “Battery Booster” initiative, designed to support the development of a fully European battery supply chain. The programme aims to strengthen domestic production capacity and reduce dependence on imports.

The initiative has been welcomed by Verkor, a French battery startup that this week opened its first large-scale lithium-ion battery plant in northern France. The company described the Battery Booster as “a necessary step” in scaling Europe’s battery industry, particularly after the struggles faced by Swedish battery maker Northvolt.

Uncertain Signals for the Market

Nonetheless, critics argue that the investment falls short of counteracting what they view as mixed messaging on the EU’s commitment to decarbonisation as an engine of economic growth. Some traditional automakers have already warned that the carbon offset requirements could raise vehicle prices, potentially undermining consumer demand.

Further uncertainty surrounds the United Kingdom, which has yet to indicate whether it will follow the EU in revising its own 2035 ban on combustion-engine vehicles. Unlike the EU and the United States, the UK has not imposed tariffs on Chinese EVs, even as their market share continues to rise.

The unfolding debate underscores the delicate balance policymakers face: supporting existing industries while accelerating the shift to cleaner technologies. As Europe recalibrates its approach, the decisions taken now are likely to shape whether the region emerges as a leader — or a follower — in the rapidly evolving global electric vehicle market.

Source: Techcrunch

news via inbox

Get the latest updates delivered straight to your inbox. Subscribe now!