Bridgewater Warns of Risk in Big Tech’s External Capital Reliance on AI Investments

Bridgewater Associates cautioned on Tuesday that major technology companies’ mounting reliance on external capital to fund massive AI expansion projects could pose significant risks, raising concerns about sustainability and market stability. The warning came as executives at the hedge fund highlighted a surge in external funding for AI build-outs — jumping from roughly $15 billion in 2024 to about $125 billion this year — far outstripping internal cash generation and prompting bubble warnings. Bridgewater’s co-chief investment officer, Greg Jensen, described the trend as potentially “dangerous,” pointing out that rapid capital deployment for AI, data centres and related infrastructure may not yield commensurate returns if growth expectations falter. The warning followed soft quarterly forecasts from tech firms, including comments from Oracle that echoed broader investor anxieties about the pace and ROI of AI-driven spending. Investors and analysts are now debating whether current investment levels are justified by future earnings predictions and whether valuations in tech can sustain their buoyancy.

Bridgewater’s alert amplifies concerns that the AI boom could be creating concentration risk in the U.S. economy, with disproportionate capital flows focused on a relatively small group of tech leaders. Jensen noted that if these firms cannot convert AI investment into robust profits, market corrections could be sharp and widespread — potentially spilling over into broader equity markets. The reliance on external capital, rather than internal cash flows, distinguishes this cycle from earlier technology booms that were more self-funded. This dynamic could lead to increased volatility in funding markets as investor appetite for high-growth tech remains sensitive to macroeconomic shifts and earnings results.

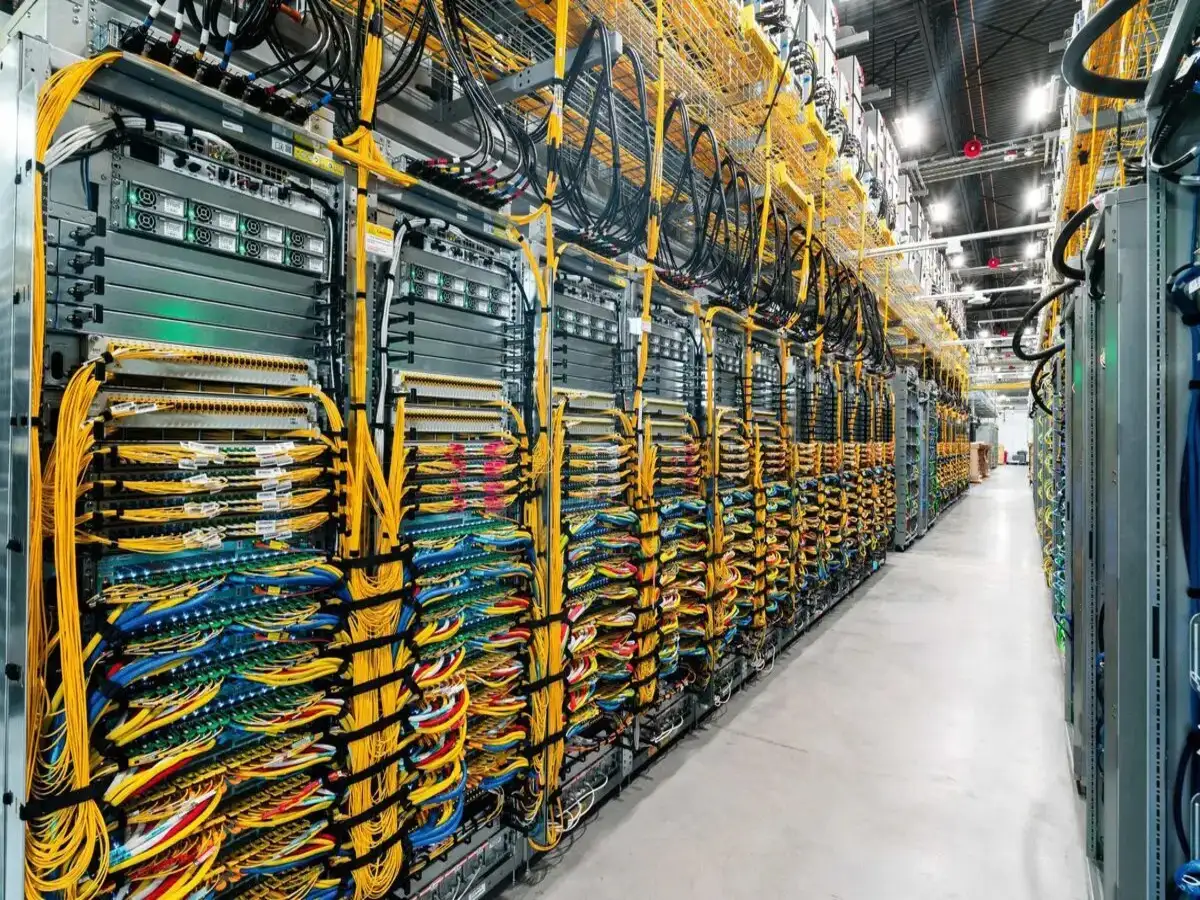

Pressure on tech valuations has already been evident as some indices and growth stocks have lagged earlier performance peaks, with investors seeking clearer earnings visibility before committing fresh capital. Critics also warn that overcapacity in data centre infrastructure, rising memory and chip costs, and competitive saturation could compress profit margins even for dominant players. Bridgewater’s stance invites comparison with past cycles where exuberant capital deployment preceded sharp corrections in sector valuations.

Policy makers and regulators are paying attention to these dynamics given tech’s significant weighting in major equity indices — a sharp correction in AI valuations could have macro ripple effects. For pension funds, institutional investors and wealth managers, risk assessments may shift toward hedging and risk-management strategies if capital reliance continues to outpace earnings growth. Some investors have already started demanding more conservative valuation frameworks and scenario planning that account for slower monetisation of AI investments.

In this context, Bridgewater’s warning serves as a reminder of the fine line between transformative innovation and overextension. As AI continues to reshape industries, the sustainability of investment patterns and the viability of long-term revenue models remain open questions. Market watchers will closely track corporate earnings, capital expenditure announcements, and funding patterns as 2026 unfolds.

Source: Reuters

news via inbox

Get the latest updates delivered straight to your inbox. Subscribe now!