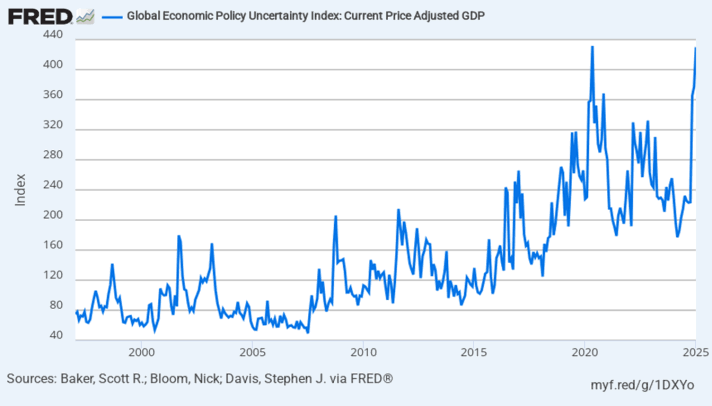

Investors Shift Toward Non-U.S. Assets as Policy Uncertainty Grows

Amid growing unpredictability in U.S. economic policy, investors are allocating more capital toward assets outside the United States, according to market analysis on Thursday, a shift that underscores rising confidence in “middle power” economies.

Strategists noted increased exposure to European and Asian equities, energy stocks and currencies like the Canadian dollar and euro as alternatives to traditional U.S. dominance.

Recent speeches by global leaders advocating strategic autonomy, along with strong earnings growth in non-U.S. markets, have reinforced this diversification trend.

Funds dedicated to European strategic themes have gained traction among institutional investors seeking improved resilience and growth prospects.

Investors cited concerns over potential policy instability in the U.S. as a driver for reallocating risk assets, even as domestic macro data remains robust.

The diversification is also seen as a hedge against concentrated risk in any single market. ETFs and multi-asset funds reflected flows into non-U.S. exposures, with demand particularly notable in Asian tech and European industrial sectors.

Emerging market equities also benefited from these flows, drawing attention to Indonesia and other high-growth economies with robust domestic demand.

Currency markets showed corresponding moves, with pro-growth currencies outperforming the U.S. dollar in day-trading sessions.

Analysts said strategic asset allocation may continue to evolve as global investors balance growth, rates and geopolitical considerations.

However, some market watchers warned that global diversification does not eliminate risk and that cross-market contagion or synchronized downturns could still occur in stressed environments.

Risk management strategies remain central to global portfolio adjustments.

Overall, the trend toward non-U.S. asset exposure reflects confidence in diversified economic fundamentals, even as investors stay vigilant for policy shifts and macro surprises that could affect global flows.

Source: Reuters

news via inbox

Get the latest updates delivered straight to your inbox. Subscribe now!