PalmPay Negotiates to Acquire Up to $100 Million

PalmPay, a digital bank in Africa that is expanding rapidly, intends to solicit up to $100 million in investment capital from investors.

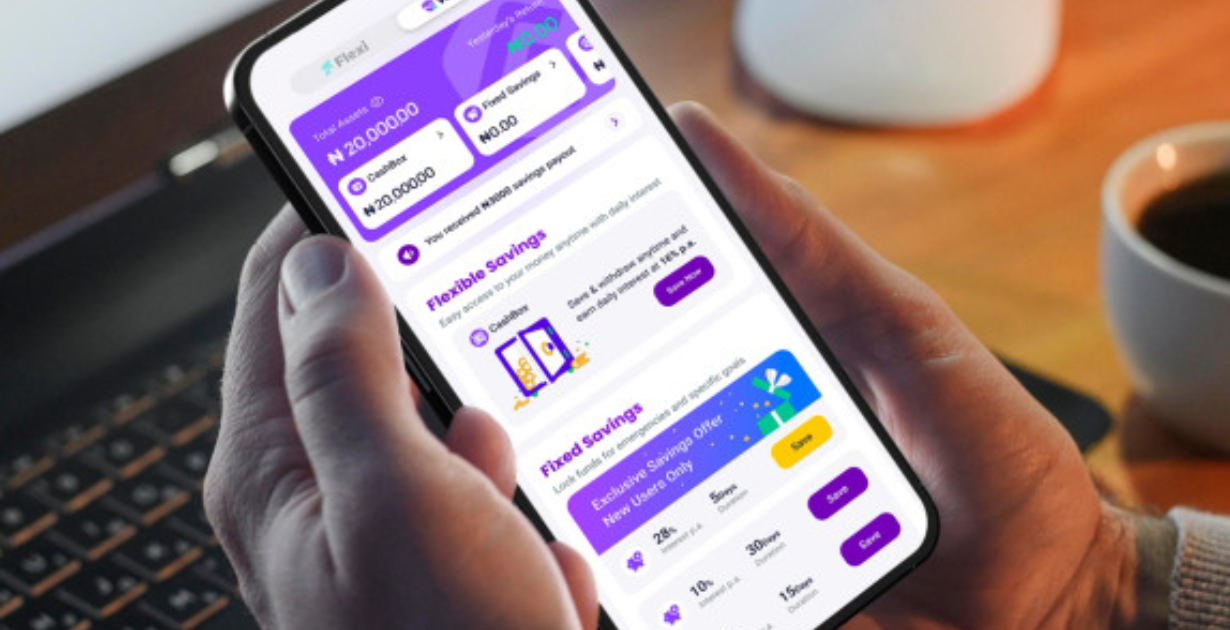

The organization, which is recognized for simplifying the process of sending money, paying expenses, and shopping online, is currently profitable.

This funding round is a component of PalmPay’s overarching strategy to broaden its services to a greater number of African countries.

In 2021, PalmPay raised $100 million and was on the brink of being valued at $1 billion.

Subsequently, it has emerged as one of the most reputable mobile payment applications in Nigeria and other regions of West Africa.

The organization intends to establish additional partnerships and provide users with enhanced capabilities.

This new round of funding has the potential to accelerate PalmPay’s growth and enable the organization to enhance security, introduce new products, and broaden its reach to a greater number of businesses and consumers.

PalmPay is also interested in expanding its presence in the burgeoning fintech sector of Africa.

The expansion of PalmPay is indicative of the transformation of African lives that is being facilitated by mobile banking.

PalmPay and other platforms are facilitating the management of money for millions of individuals in a more secure and convenient manner, as an increasing number of individuals are adopting contactless transactions and utilizing devices.

The company’s success is also capturing the attention of international investors who are enthusiastic about supporting Africa’s tech-driven future.

PalmPay could become one of the first fintech unicorns on the continent if the funding round is successful, which would serve as tangible evidence that African technology is experiencing significant growth.

news via inbox

Get the latest updates delivered straight to your inbox. Subscribe now!